By: Dr Muhammad Imran Usmani

Last week, I embarked on a whirlwind three-day trip to Lahore, Pakistan, immersing myself in the dynamic world of Islamic finance and the city’s captivating culture.

My journey began with a collaborative workshop hosted by Meezan Bank, the Centre for Islamic Economics, and the Microfinance Companies’ Association. This insightful session fostered dialogue and knowledge exchange, highlighting the collaborative spirit within the financial sector.

Following the workshop, I witnessed a momentous occasion – the groundbreaking ceremony for Meezan Bank’s new Lahore regional head office building. This ceremony marked a significant milestone in the bank’s expansion plans, solidifying its commitment to serving the local community.

Next, I delved into strategic discussions with Meezan Bank’s Shari’ah Board and Board of Directors. These meetings provided valuable insights into the bank’s future direction and its unwavering dedication to adhering to Islamic financial principles.

As the days unfolded, I found myself in the company of esteemed members of the Meezan Bank Shari’ah Board and Board of Directors, engaging in insightful discussions and strategic planning sessions. It was a privilege to be part of these meetings, witnessing firsthand the dedication and vision driving the bank forward.

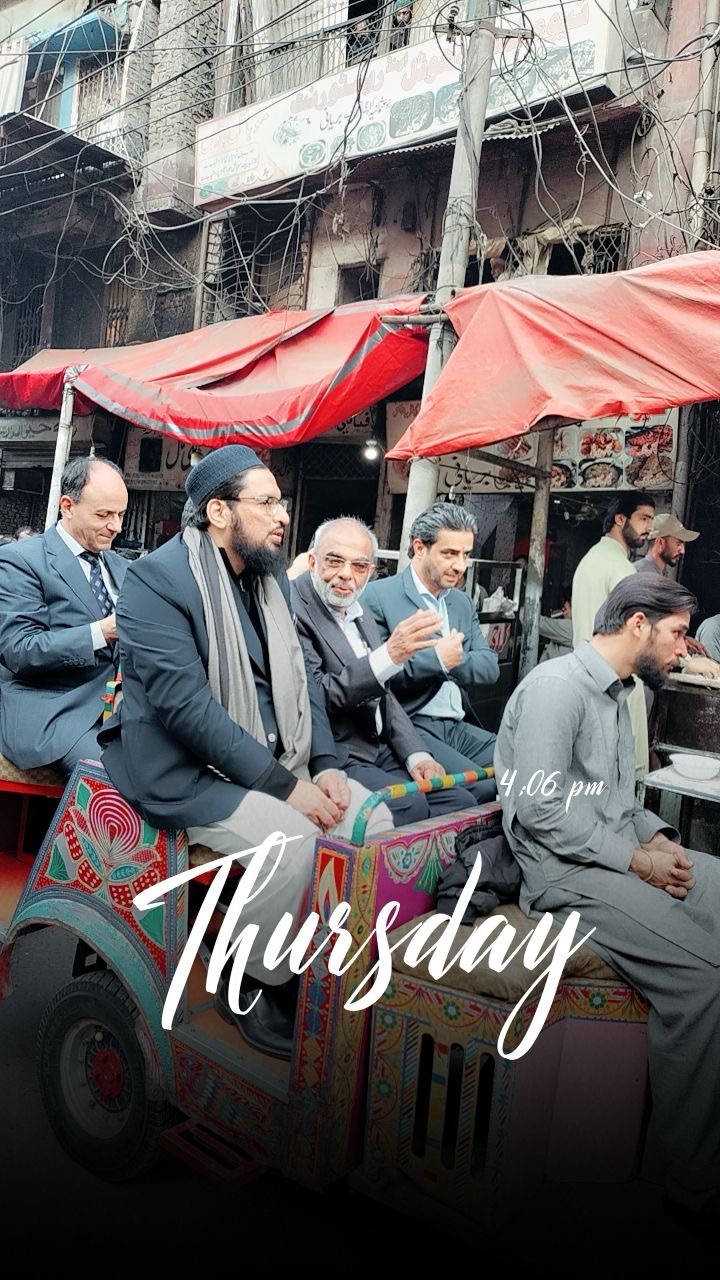

Yet amidst the hustle and bustle of business, I was drawn to explore the timeless charm of Lahore’s old city. From the vibrant streets of Shah Alam Bazar to the majestic Sunehrei Mosque, every corner seemed to whisper tales of bygone eras. But it was a narrow, winding street or lane leading to the Wazeer Khan Mosque that truly captured my imagination. Navigating through the labyrinth of alleys, I found myself transported to another time—a time when merchants bartered their wares and storytellers spun their tales.

It was a journey back in time, made all the more enchanting by the company of my fellow travelers among our foreign guests who are members of the Board of the bank. I am sure they were enchanted as well to see such beauty in the East for the first time.

As we ventured deeper into the heart of the old city, we stumbled upon the branches of Meezan Bank, tucked away in the midst of the bustling bazaar. What struck me most was the sight of people streaming in and out, their faces lit up with a sense of purpose and determination. It was a testament to the trust and confidence they placed in the bank, a trust that seemed to transcend the boundaries of time and space. Reflecting on my experiences, I couldn’t help but ponder the secret behind Meezan Bank’s success. Was it the superior service offerings, the skilled marketing team, or perhaps the brand’s indomitable reputation? As I delved deeper into the question, I realized that it was none of these things alone. Instead, it was the bank’s unwavering commitment to its core values, rooted in the principles of Islamic finance. In a world where trust is currency, Meezan Bank had emerged as a beacon of integrity and reliability—a testament to the enduring power of faith and fidelity. But amidst the celebrations, I couldn’t shake the nagging thought that there was still much work to be done. Despite the bank’s success, many smes were still struggling to access the financing they needed to thrive. It was a sobering reminder of the challenges that lay ahead, yet also a call to action.

Unlocking financing potential for Pakistan’s SMEs:

While Small and Medium Enterprises (SMEs) contribute significantly to Pakistan’s economy, access to finance remains a critical challenge. Despite billions in deposits from these businesses, traditional financing pathways often remain elusive. This untapped potential presents a win-win opportunity for banks and smes alike.

By analyzing branch-level data and annualizing figures, banks can readily identify promising short- and long-term financing opportunities within the SME sector. This not only offers banks attractive returns but also empowers smes to scale their operations, creating a robust ecosystem.

Consider a pilot program in Lahore’s bustling markets. By tailoring financial products and services to the specific needs of smes in this area, Meezan Bank can unlock immense potential. This model, replicable across Pakistan’s diverse markets, promises benefits for the bank, businesses and overall economy, it would be closer to the objectives of Shari’ah to spread the wealth in masses.

Unlocking New Markets with Technology: A Strategic Opportunity for Meezan Bank

While challenges exist, we must leverage big data analytics, AI-powered credit scoring, and efficient digital platforms to unlock financial inclusion for the vast majority of the population. These technologies have opened up previously untapped markets, representing over 99% of the economic landscape. With its extensive customer base, Meezan Bank is uniquely positioned to capitalize on this opportunity and achieve the next level of success, before competitors seize the initiative. And I’m quite confident that we will reach this milestone soon enough.

This observation, gleaned from my recent trip, highlights a potentially transformative path for Meezan Bank. I welcome any dissenting viewpoints or additional suggestions to further refine this strategic approach and take this discussion further!